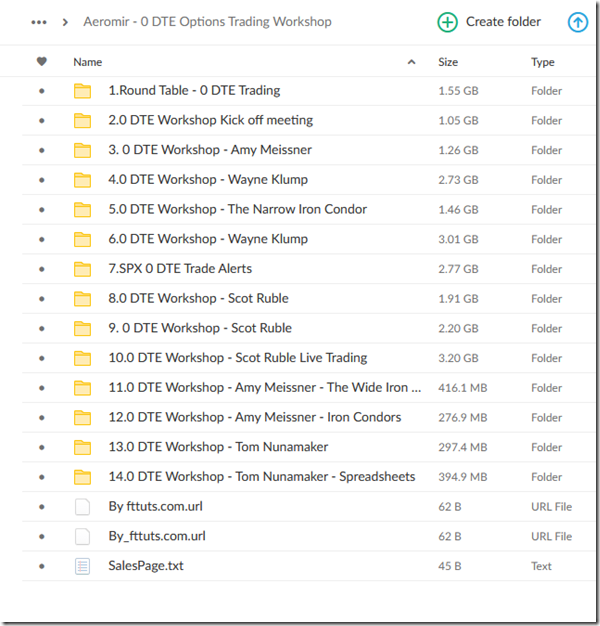

Aeromir – 0 DTE Options Trading Workshop

PRICE: 25$ (New Price 13$)

This course is a Group Buy and it is not available for free to Members…..

What are 0 Days-to-Expiration (DTE) Options Trades?

0 DTE option trades are trades that expire the same day the trade is entered. These trades are commonly referred to as “0 DTE”, “same-day expiration” or “same-day expiry” trades.

SPX options now have daily expirations and plenty of available liquidity. This is why we primarily trade SPX options.

There are many ways to trade 0 DTE options that include directional or non-directional trades. We primarily focus on non-directional trades but traders can take a directional position using options in different ways.

What are the strategies covered in the workshop?

These are the main strategies that were covered in the workshop:

-

Jim Olson Iron Butterfly – This is a wide butterfly spread entered at the open of trading. Typical trades are opened and closed in 10-20 minutes.

-

Narrow Iron Condor – Dan Harvey combined an Iron Butterfly and an Iron Condor and created the Narrow Iron Condor. This trade is highly flexible and has had an 80-85% win rate for multiple people in our community.

-

The Morning Fade – Scot Ruble at stratagemtrade.com used this technique in the CBOE pits as a market maker and still uses it today. It has roughly an 80% success rate.

-

Trading the Market-on-Close (MOC) buy/sell imbalance – Scot Ruble at stratagemtrade.com uses this technique at the end of the day to go long or short in the last 10-minutes of trading if the right conditions are met.

-

The Wide Iron Butterfly – Amy Meissner will teach one of her favorite strategies that she has excellent results with.

-

Amy’s Iron Condor Variations – Amy Meissner will teach her favorite iron condor strategies.

-

Wayne’s Calendar spreads – Wayne Klump will teach how he trades Calendar spreads using his proprietary tools.

-

Out-of-the-Money Vertical Spreads – Tom Nunamaker will teach how he uses far-out-of-the-money vertical spreads that expire the same to day to harvest money from the markets. Tom had 12 of these trades in February with no losers that made just under $900 using $3,000 to $9,000 of margin each day.

-

Breakeven Iron Condor – John Einar’s most profitable options trade. John Einar had an annual yield of more than 70% in 16-months of trading. Tom Nunamaker will show you an easy way to load these trades into thinkorswim.

-

Asymmetric Risk Butterflies – Ernie at 0-dte.com uses asymmetric risk trades to achieve great results with low risk. Tom Nunamaker will review this type of trade and how to quickly find suitable candidates.

SIZE: 22,4 GB

PRICE: 25$ (New Price 13$) Original Price: 999$

If you are interested and you want this course, please

ask for it at [email protected] or [email protected]

I will send you payment options as soon as possible but

not longer then 24 hours

Thank you for your understanding

The course will be delivered to you by Mega download

link

Proof of Files:

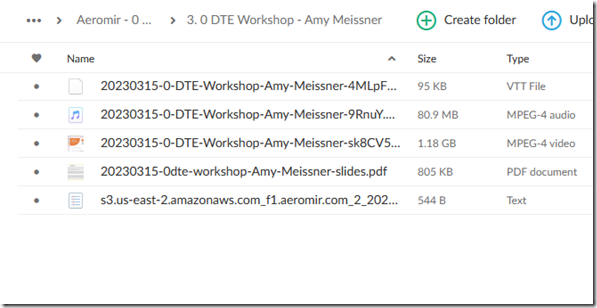

Example:

Leave A Comment

You must be logged in to post a comment.