StratagemTrade – Advanced Risk Reversal (Class Only)

PRICE: 30$ Original Price: 699$

This course is a Group Buy and it is not available for free to Members…..

A Risk Reversal is perhaps the ideal strategy for a directional trade that is more forging than a long option or vertical spread. By strategically placing a long vertical call spread and a short put spread (or the reverse), traders mitigate volatility, skew and time premium risk associated with a directional trade such as a vertical spread, while allowing a huge room for the market to move in the wrong direction without a loss. That doesn’t happen with a long call or put spread.

The key to this trade is the correct selection of strike prices, width of vertical spreads, expiration dates, and adjustment/hedging techniques. Perhaps this is why so many large traders and firms use this strategy as a speculation and hedging tool.

This is a strategy we are going to be using very often in POT classes during this low volatility environment that is frustrating most traders. Why? It can implemented in any market condition, and it ideal for overbought and over sold market conditions.

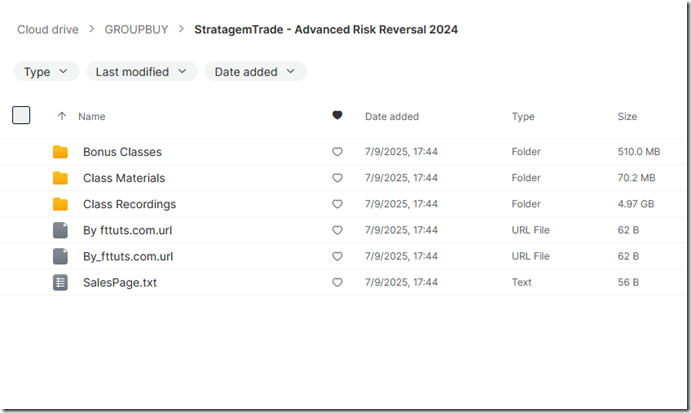

SIZE: 5,5 GB

PRICE: 30$ Original Price: 699$

If you are interested and you want this course, please ask for it at

[email protected] or [email protected]

I will send you payment options as soon as possible but not longer than 24 hours

Thank you for your understanding

The course will be delivered to you by Mega download link

Proof of Files:

Leave A Comment

You must be logged in to post a comment.